~ Key Benefits ~

Malta Residency Program Overview

Malta Life Overview

Malta Tax Benefits Overview

Business and Legal Environment Overview

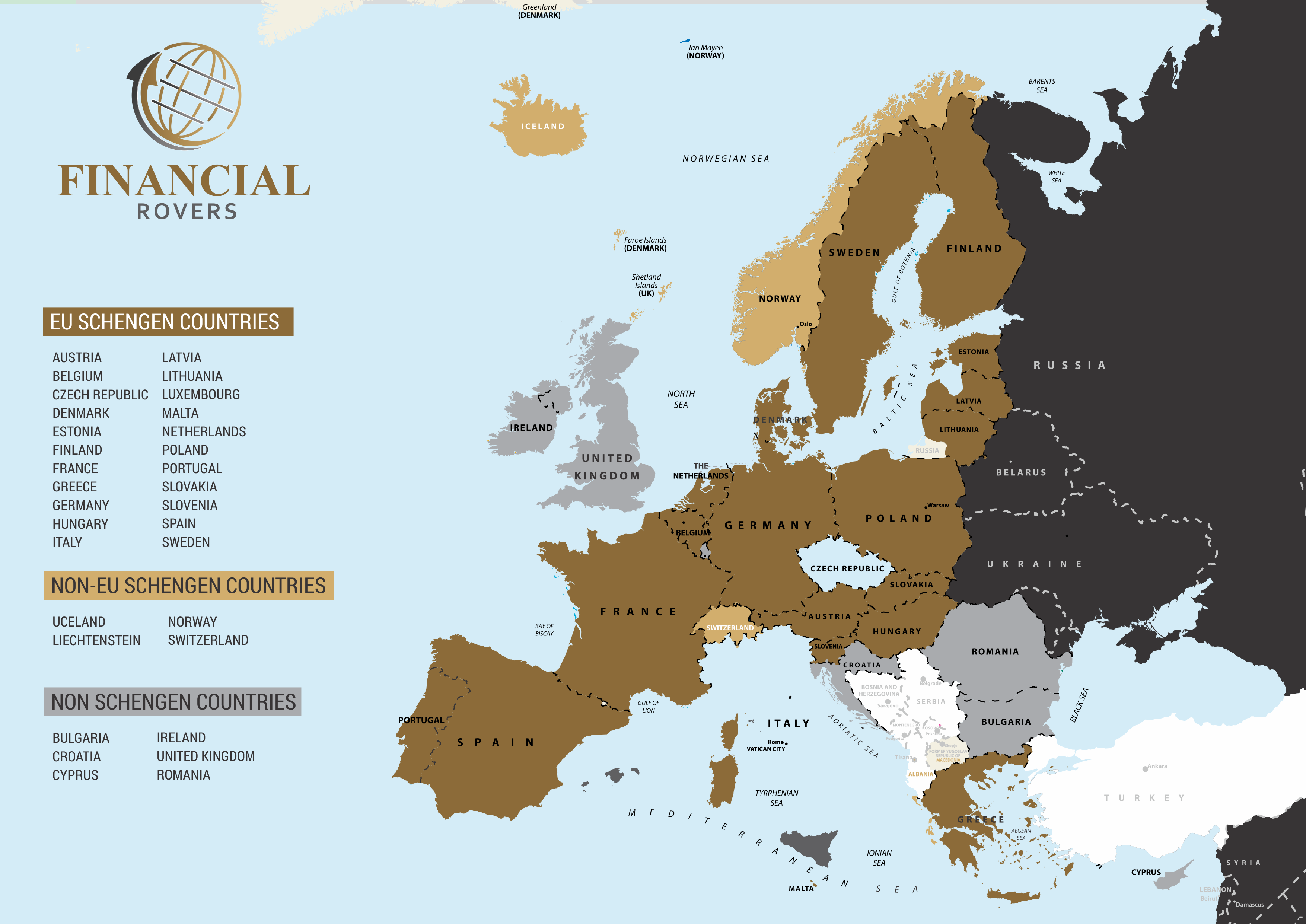

Location is one of the primary reasons that make Malta an attractive business destination. Malta is strategically located at the heart of the Mediterranean with very close ties to mainland Europe, North Africa, and the Middle East. Rated as one of Europe’s best performing and one of the fastest-growing economies in the world.

Why do businesses choose Malta to set up shop? For starters, Malta has one financial services regulator, the Malta Financial Services Authority (MFSA), meaning less bureaucracy. Furthermore, Malta has created an advantageous tax and trade environment that companies can thrive. Amongst others, the company tax stands at 35% on all profits, with shareholders claiming up to 6/7ths refund on the distribution of a dividend, which essentially reduces the corporate tax burden to 5%. Additionally, Malta is part of over 70 double tax treaties, which opens the door to most global and developing economies in the world.

Another major advantage that puts Malta high on the map of business destinations is the ease of doing business, low operations cost, and innovative business structures that allow companies to set up and run their business quickly and efficiently. The country has placed a lot of effort, time, and resources in creating the ideal environment and right conditions for companies to develop, launch and scale their business.

Criteria for granting an Immigration Permit within the scope of the expedited procedure to applicants who are third country nationals and invest in Malta.

2. INVESTMENT CRITERIA

Applicants can apply under the Malta Permanent Residence Programme (MPRP) by investing to a real estate investment (purchase/lease) and a donation to a charity organization.

| Purchase Option | Lease Option |

Government Admin Fee | €40,000 | €40,000 |

Government Contribution | €28,000 | €58,000 |

Purchase Criteria | €300,000 (Gozo/South of Malta) | N/A |

Lease Criteria | N/A | €10,000 / year (Gozo/South of Malta) |

Minimum Donation | €2,000 | €2,000 |

At present the qualifying property for P.R in south Malta must be purchased for a minimum of €300,000 or rented for €10,000, while properties in the rest of Malta must have a minimum value of €350,000 or €12,000 in the case of rent.

A total contribution of €70,000 is payable for investors who purchase a qualifying property, whilst a contribution of €98,000 applies in case of lease.

3. ELIGIBILITY CRITERIA

Conditions and qualify criteria of Malta Residency by Investment program:

The main applicant:

Residence applies to the whole family:

*An additional fee of €7,500 each (parents and grand-parents of the main applicant and spouse), plus donation €2,000.

4. TIME SCHEDULES

If all the criteria of this policy are met and if there are no reasons with regard to either the applicant’s criminal record or to public order and public security issues, the application will be forwarded for examination.

It is estimated that the examination period of the application from the date of submission of the completed application will be approximately 4-6 months.

© Financialrovers, 2021. All Rights Reserved. Build by Webelephant Technologies LTD